Indian Equities: The selling of FIIs is being absorbed by DIIs in some way.

30 May 2022

Indian Equities: The selling of FIIs is being absorbed by DIIs in some way.

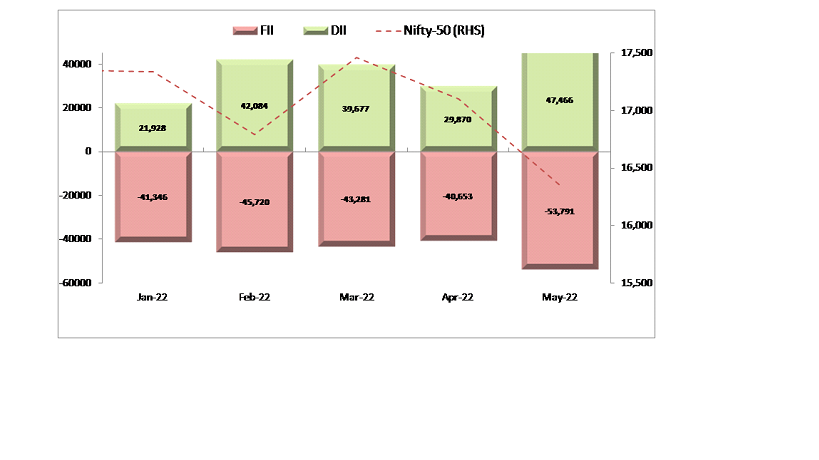

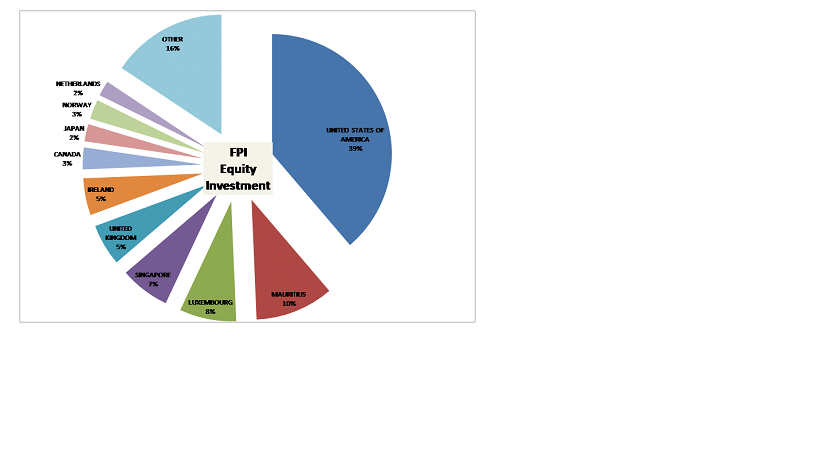

The significant drop in the benchmark indices has corresponded with FII outflows. Since the start of 2022, the Sensex and Nifty have corrected about 8% year to date. Since the benchmark Nifty50 Index hit record highs of 18604 in October last year, FIIs have been aggressively selling Indian assets. FIIs have sold shares worth Rs 224791 crore so far this year, according to statistics from the National Securities Depository Limited (NSDL) (as of May 27, 2022).

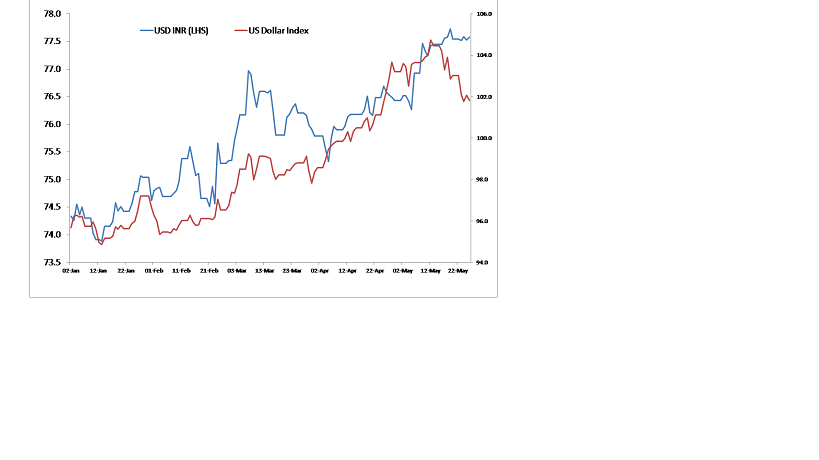

Any central bank's normal response to combat inflation is to raise interest rates. People are finding it more difficult to borrow and spend as interest rates rise. Global central banks have recently begun to raise interest rates and have opted to halt the liquidity infusions that have been used to sustain the economy. Emerging markets (EMs) become less tempting investment opportunities for international investors as interest rates rise. The US Federal Reserve's choices to raise interest rates and stop buying bonds began to erode the system's liquidity. It is one of the main causes of the current stock market drop in India. Furthermore, because many emerging market economies are net importers of several commodities, the impact of the Russia-Ukraine issue is greater than that of developed market economies. High oil, food, and fertilizer prices, exacerbated by the Russia-Ukraine crisis, continue to stifle India's economic progress. Moody's Investors Service cut India's economic growth forecast for 2022 from 9.1 percent to 8.8 percent on Thursday, citing excessive inflation. Moody's, on the other hand, keeps its growth prediction for 2023 at 5.4 percent. The US Dollar continues to attract global investors, making it the leading safe-haven asset.

Domestic Institutional Investors (DIIs) and retail individual investors, on the other hand, are absorbing some of the selling by FIIs. According to data from the National Securities Depository Limited (NSDL), DIIs have purchased shares worth Rs 181025 crore so far this year(as on 27 May 2022). Indian individual investors are increasingly engaging in the Indian equity market on a regular basis. Every month, for example, only mutual fund SIPs of roughly Rs 10,000 crore are invested in equities markets. There are further contributions from the NPS, EPFO, pension funds, and other sources. Even direct stock purchases by Indian retail investors have increased significantly in the last two years.

As a result, even if FIIs withdraw their investments, all of these reasons may limit the down fall in Indian equities markets. Once international tensions subside, the dollar will lose part of its safe-haven reputation in the near future. As a result, money will flow out of the dollar and into other parts of the world, boosting developing market stocks.

Founded in 2005 by new–age entrepreneur Abhishek Bansal, the Abans Group has evolved into a globally diversified conglomerate, providing expertise in Broking Services,

Non-Banking Financial Dealings, Financial Services, Agri-Commodity Services, Warehousing, Realty & Infrastructure, Gold Dore Refinery & Manufacturing, Trading in Metal Products, Pharmaceuticals,

Software Development & Wealth Management. The Group is a comprehensive financial and non-financial services and solutions provider, aiming to provide end-to-end solutions to its clients.