GST collection figures show that India's growth story is still intact

03 Jun 2022

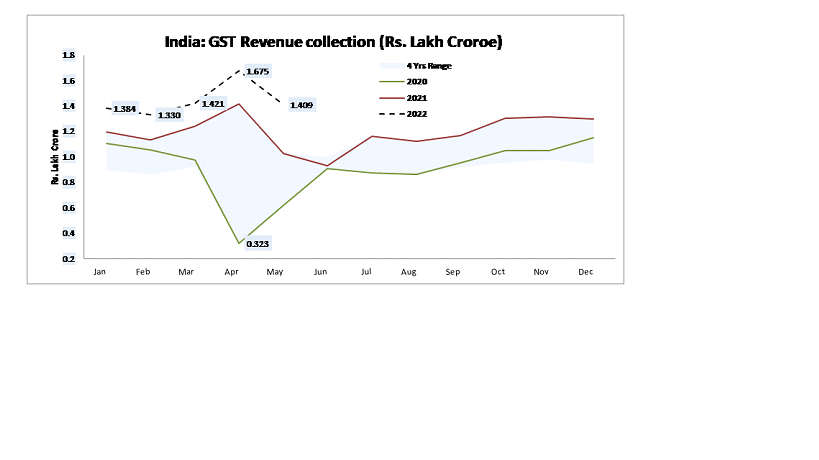

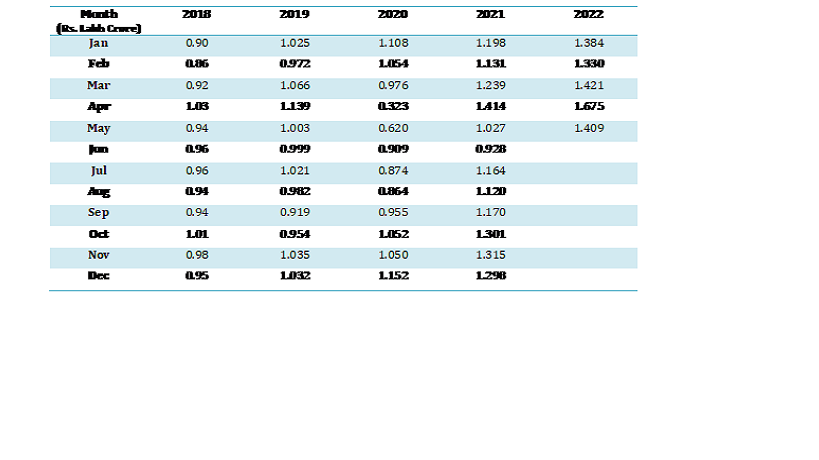

Despite a number of global concerns, as well as rising interest rates by leading central banks to cool inflationary pressures, global investors are looking to India. GST revenue numbers are key indicators of economic conditions. India’s GST revenue collection in May’22 stood at Rs 1,40,885 crore, 44% higher on a year-on-year basis, as per the government data. This is the third consecutive month when the GST revenue crossed Rs 1.4 lakh crore mark. Also, since the GST regime was implemented in July 2017, this is the fourth time when the GST revenue crossed this threshold.

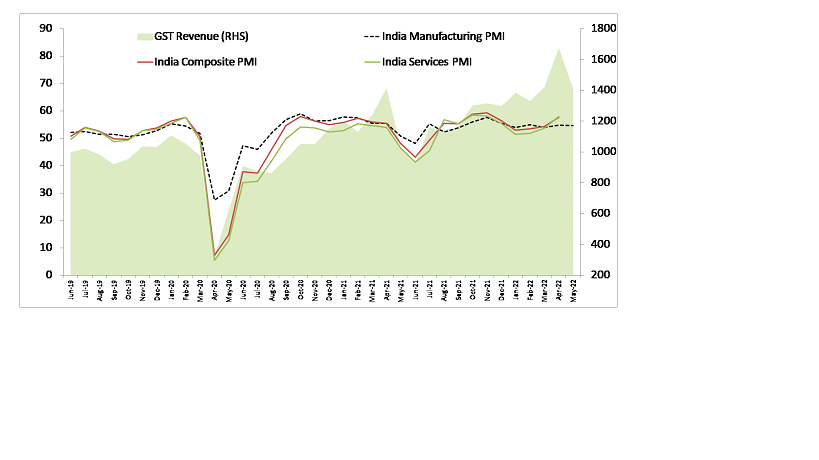

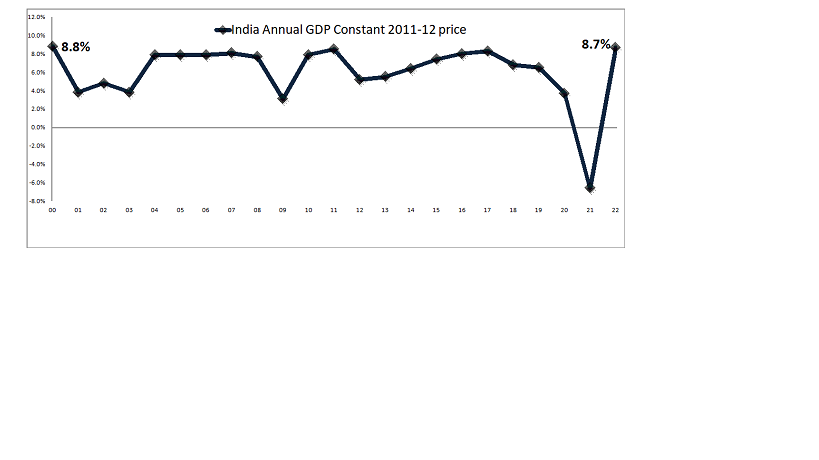

The Indian economy has managed to grow by 8.7 per cent in the FY22 ( Highest in 22 years in terms of back series data).. Investment has been the main driver of India's GDP growth during the last financial year. In contrast, consumption — both private and government — trailed investment as the government’s focus has been on creating future assets while boosting economic growth. Despite historically high inflation, India's manufacturing sector expanded in May’22 and "maintained strong growth." Manufacturing, which was severely disrupted in FY21, too, had grown faster than services companies because of the lower base. The seasonally adjusted S&P Global India Manufacturing Purchasing Managers' Index (PMI) was 54.6 in May’22, unchanged from 54.7 in Apr’22 and higher than the 54.2 expected by analysts, indicating a sustained recovery across the sector. PMI growth is clearly reflected in GST revenue collection figures, indicating long-term growth in the coming months. Given the improved pandemic situation, India is likely to maintain more or less the same growth trajectory. However, inflation, monetary tightening, fiscal prudence, higher interest rates and the global economic situation could impact the growth numbers marginally.

Meanwhile, investor confidence in China has been shaken by strict lockdown regulations designed to limit the spread of covid-19-related infections. For a long time, a large portion of China has been closed down. As a result, investor confidence is shaken. In such a scenario, India becomes a natural choice for global investors. With pandemic worries behind it, we expect India to be the world's fastest growing major economy for the second year in a row.

Founded in 2005 by new–age entrepreneur Abhishek Bansal, the Abans Group has evolved into a globally diversified conglomerate, providing expertise in Broking Services,

Non-Banking Financial Dealings, Financial Services, Agri-Commodity Services, Warehousing, Realty & Infrastructure, Gold Dore Refinery & Manufacturing, Trading in Metal Products, Pharmaceuticals,

Software Development & Wealth Management. The Group is a comprehensive financial and non-financial services and solutions provider, aiming to provide end-to-end solutions to its clients.